Buy Now Pay Later Companies

In today’s world, buy now pay later’ platforms have become super handy and useful. All you need to do is sign up, get a line of credit and make payment in installments without worrying about credit scores, interest and heavy fees. One of the popular BNPL platforms is Sezzle. But if you want to try something new or if Sezzle is not active in your country, then here is a list of best Sezzle alternatives.

14 Best Sezzle Alternatives & Competitors

Sezzle is without any doubt a highly recommended platform when it comes to the buy now pay later category. However, it is possible that you are looking for something new or a platform with more features. Luckily there are many services that can easily give a strong competition to Sezzle in providing installment and credit-based features. All you need to do is compare the characteristics and sign up to start making purchases. Let us check out these Sezzle alternatives India.

1. Klarna

Klarna is a user-friendly and flexible payment option for shoppers. Whether you are shopping online or offline, you can use Klarna to pay the bill in small installments. There is an official app in app stores; however, you can also use the official website to create your own account. Simply provide a few essential details and submit the application. The application will get approved within 48 hours after a soft credit check. The credit check will not have any negative effect on their current credit score. In the beginning, the user will get a limited credit which will be based on their current credit score. However, you can improve your credit limit by paying the installments on time. You will have to pay 1/4th of your bill in the beginning and the rest can be paid in easy installments. The best thing here is the ‘no interest’ feature. But you should be aware of the late fee that is imposed if you fail to pay on time. You will be given three different options for payment:

4 Day Payment: These are a 4-day plan in which the remaining 75% bill is divided into 4 small installments with no interest. 30 Day Payment: This is a 30-day plan in which you will have to pay the remaining bill within 1 month’s time and there is no interest levied on it. 6-36 Months: In this program, you can pay small installments every month anywhere from 6 to 36 months. However, in this program, you will have to pay interest as per your bill amount.

2. PayPal Credit

If you are a PayPal user then PayPal Credit is your best pick in case you are looking for Sezzle alternatives India. PayPal’s Credit is a buy now pay later feature that you can connect with your PayPal account. PayPal will do a credit check to know your current creditworthiness and if you have a negative amount in your PayPal account, then you may find it difficult to get a line of credit. If you get approved, you can get a line of credit anywhere from $50 to $1500. There is no interest if your bill is paid within 6 months’ time. One of the best things about PayPal credit is that it is highly acceptable in most online and offline stores. Therefore, you will not have to find stores and shops specifically for PayPal compatibility. One thing to keep in mind is that if you fail to pay the balance due on time, it can lead to a high rate of interest when compared to other similar BNPL apps.

3. Venue

If you are searching for a fast and easy payment option with a huge catalog of brands and leasing services, then Venue is your pick. This platform is built for better and higher flexibility in terms of payment as one can easily check out and get the items delivered in less time. There are more than 1 million brands that allow customers to use Venue for their payment. They also provide easy and fast delivery services for customers. One should have at least $1000 in their account if they want to use Venue for transactions. Other than simple buy now and pay later features, Venue also has a leasing agreement feature. In this platform, the customers can use a product for a limited period of time and pay only for that time. After this, the product can be returned. This is quite useful of a feature as it allows customers to return the product in case they are unable to pay the bill amount.

4. Four

Four is similar to many BNPL platforms in the sense it allows you to make payments in 4 easy installments. There is a time period of 6 weeks under which you will have to make these 4 payments. Four is a hassle-free platform and your credit card won’t even be checked for credit score. You can straight up use Four without any worries. However, when signing up, it requires a 25% down payment which you need to make to use Four. Also Read: 15 Buy Now Pay Later Apps in India

5. Affirm

Affirm is a highly reliable line of credit-based short-term loan service. Here you will have to get approved for a line of credit or loan that will base on your credit history and your overall eligibility. Sign up, apply for a line of credit and wait for approval. After approval, you will be given a certain amount as your credit limit. There are more than 1000 retailers and merchants from whom you can make your purchase. Before making every purchase you will have to get approval only after which you will be given the credit limit. The maximum credit limit is around $17,000, however, one can negotiate to get a better credit limit. You can choose different payment options like 4 installment payments or 3/6/12 month payments. There is no interest or penalty of late fee involved with affirm, but your credit limit will get reduced if you fail to make payments on time. This app is among the best Sezzle alternatives India.

6. Zip

Zip is easily one of the best Sezzle alternatives, as it has all the better features of the latter and some more. You can easily sign up and start an account with Zip after filling in the details like name, email address, phone number, credit and debit card information etc. After this, the account will get approved and you will be given a credit limit based on your credit score. There are several merchants that allow Zip payment in Canada, US, UK, and Australia. You can use this method of paying in online stores as well as in offline stores. Zip allows payment in two ways; Zip pay and Zip money. In Zip pay, you get 4 installment plans, in which you can make any purchase, make the first installment payment and pay the rest three in 2-week gaps each. On the other hand, Zip money allows paying in monthly installments for 6 months. Both payment methods do not levy any interest for the said period of time. However, after the time limit, you will have a late fee of $6 and interest on Zip Pay and Zip Money respectively. The maximum line of credit on zip money is $30,000.

7. ViaBill

Just like any other BNPL app, ViaBill allows you to divide payments for a certain amount of time. If you are looking to skip paying interest then this app can be useful. It is very easy to use this app, all you need to do is to use to ViaBill when making your payments in a shop or similar place. Once you pay, the money will get deducted from your registered card in the form of a down payment. You will be charged $15 in the circumstances of late payment. This is how ViaBill remains profitable. It takes no time to get approved on this app so that is a plus as well. Another advantage of using ViaBill is that your credit score is not disturbed by it.

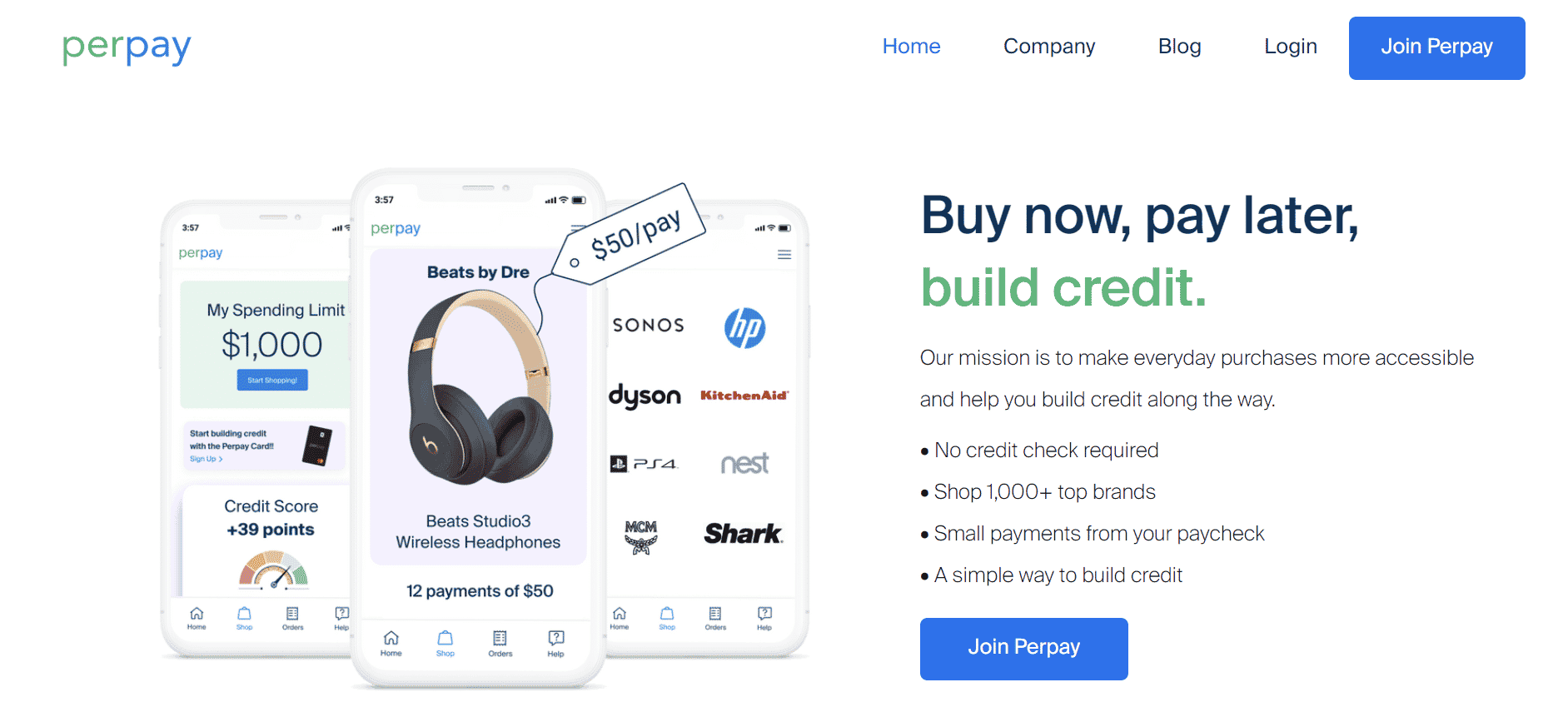

8. Perpay

If you are on the lookout for a payment service that allows people with poor credit to get a line of credit, then Perpay is the right choice. This payment service is mostly available for bigger brands like Samsung and Apple. You can make bigger purchases with Perpay as it is easy to get a repayment time period of 12 months. You can make monthly installment payments with no added interest. If you are looking for Sezzle alternatives India, you have to check this one out. Perpay sign-up is based on your income and therefore, it is a must for the candidate to get a full-time job. You will have to make the payments on time; otherwise, Perpay will inform late payments to credit bureaus. This can be a good way to improve your credit score over time. If the payments are not done on time, you will have to pay a late fee which can go up to $35. Also Read: How to buy Gold Bonds?

9. Shop Pay By Shopify

This BNPL service is by Shopify, which is a highly coveted e-commerce provider. Shop Pay is a payment service that allows users to make easy and hassle-free payments both online and offline. This payment method can be integrated with all types of e-commerce stores regardless of whether they are hosted by Shopify or not. You can make full payments or installment-based payments using the payment method. You can choose Shop Pay during checkout and add your debit or credit card information for the first installment payment. After the verification process is done, you will get a message where the rest of the installment information will be mentioned. Every month the installment will get auto deducted from the account. There is no late fee involved in case of late payments or missing payments, but your account will get deactivated and you will be barred from making any other purchases.

10. Splitit

Splitit is a popular and pretty new option in terms of buy now pay later companies. However, it is growing rapidly with a sizeable number of users in the last few years. You can make easy and fast payments using this platform without divulging much of your personal information. If you are worried about credit checks, then don’t be. Splitit does not perform any credit checks and requires only basic information to activate your account. There are several small and big brands and merchants that provide Splitit as one of their payment methods. You can choose from different installment plans that can range from 4 months to 24 months. There is no interest on the payments and neither is there any late fee. We had to include this platform in this list of Sezzle alternatives India.

11. Fingerhut

One of the best features of this app is that it does not check the payment history of your card. hence the approval is fast and easy. By making timely payments in this app, you can also improve your credit score. One of their payment plans also allows you to make payments without any interest which is a huge positive.

12. AfterPay

If you are looking for a simple and easy-to-use buy now pay later companies that will make your online or offline shopping easy, then, AfterPay is a great alternative to Sezzle. This application was initially launched in Australia in the year 2014, and then it expanded to the United Kingdom and the USA in 2018. This platform allows customers to pay their online bills in four installments. In this platform, one payment has to be made initially during checkout and the rest three can be paid in a gap of two weeks each. The best thing about this application is that there is no interest or hidden fees involved. However, you will have to pay a late fee ($10 if paid within a week of the due date) in case you miss the payment’s due date. Initially, the credit limit is restricted to $150, which can be increased as per the payment history. AfterPay does not perform a credit check and requires only email ID, phone number, and credit/debit card details to start making transactions. Also Read: LazyPay Payment App: Why do you need it?

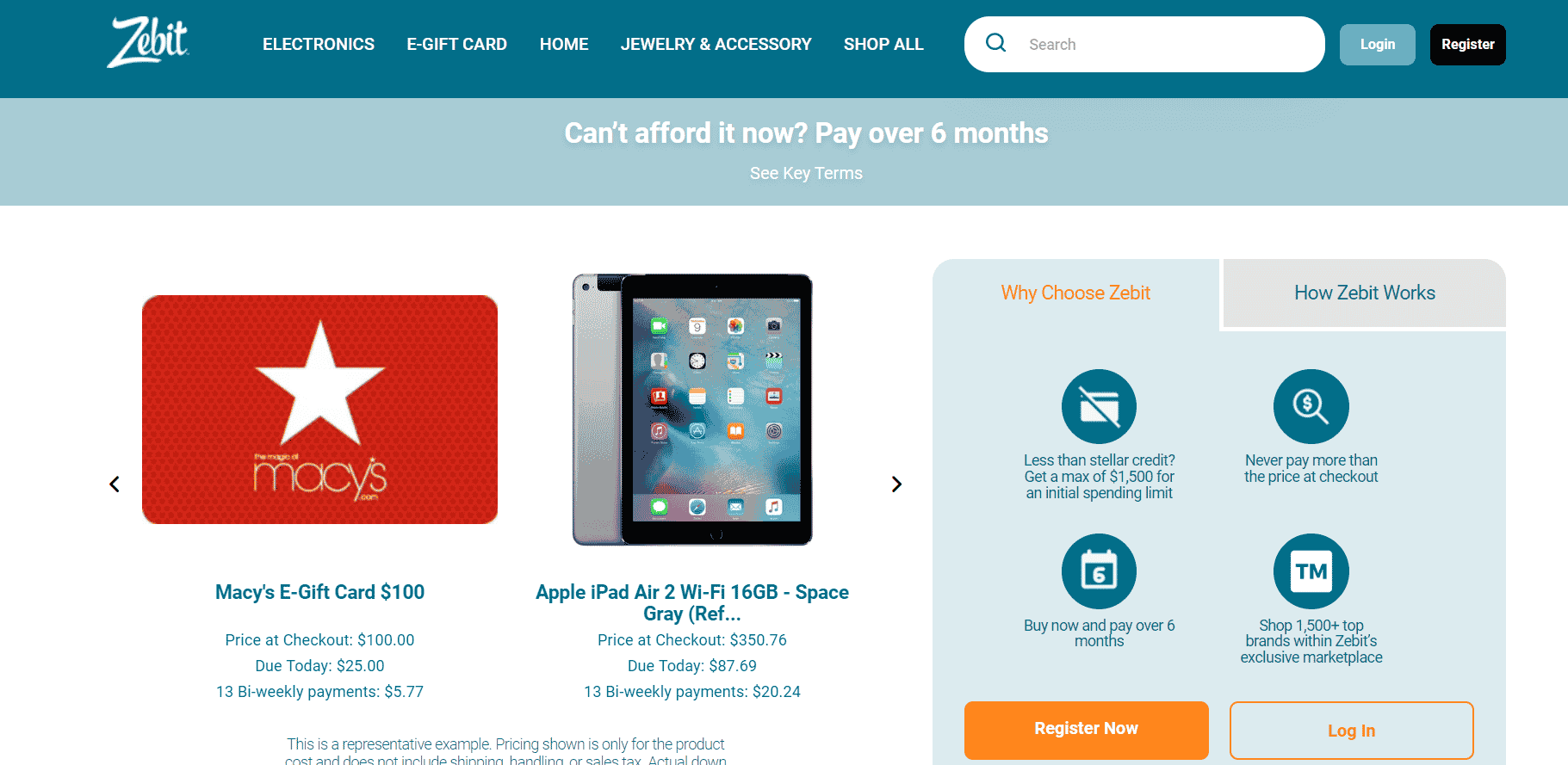

13. Zebit

Your last option among Sezzle alternatives India is, Zebit. This is a fairly attractive choice if you are wary of credit checks, interest, and late fees. Zebit allows users to make purchases using a line of credit that is approved for them as per their income. Instead of doing a credit check, Zebit works alongside employers to know the income of the user and how much credit they are eligible for. The maximum line of credit you can get here is $2500. You can make purchases from a large network of retailers and merchants. All you need to do is pay the initial installment and then the rest of the installments are to be paid within 6 months’ time. Your purchases will be shipped only after you pay the down payment of 25% of the bill amount. There are no late fees but if the installments are not paid on time, it can lead to a deduction of the credit limit.

14. Pay in 4 by PayPal

Pay in 4 program can wholeheartedly be trusted due to its association with PayPal. Let us be honest, who hasn’t heard of PayPal, they are a giant in the online payments market so this program can be trusted without any issue. It is a standard BNPL service that lets you divide your bill payments into small segments. It is especially beneficial if you use PayPal. As the name suggests, if you are a PayPal user you get to enjoy the benefit of making your payments in four easy sections without any additional cost whatsoever. One caveat of this program is that if your PayPal balance is below zero that you can find difficulty in using this service. The price range in which you can utilize this program starts from a meager 30 dollars and goes all the way up to 1500 dollars. As PayPal is accepted by the majority of sellers, this program will never fail you. These platforms are undoubtedly some of the best choices when it comes to BNPL features. With these apps, it is easy to make purchases and make payments, as you are not paying in a lump sum but in smaller amounts. All these Sezzle alternatives and Sezzle alternatives India will make your shopping experience fun and financially less taxing. You can choose as per your location, the brands you frequent, and your target line of credit. Review, compare and then sign up to make your online shopping hassle-free and fun!