The annual inflation rate in the United Kingdom has been averaging around 2.5 % between 1989 to 2017. This means these investments are actually earning a negative return. While there are many banks that give higher rates in the UK, they are essentially small banks and co-operative unions who have a weak branch network and are located in far off places in small towns. Moreover, the paperwork involved, before you park your cash with these banks is a deterrent. An individual needs to submit multiple forms to ensure he gets the full benefits of a higher interest rate. Now that’s a problem that many new fintech companies are trying to solve. Octopus Investments is one of them.

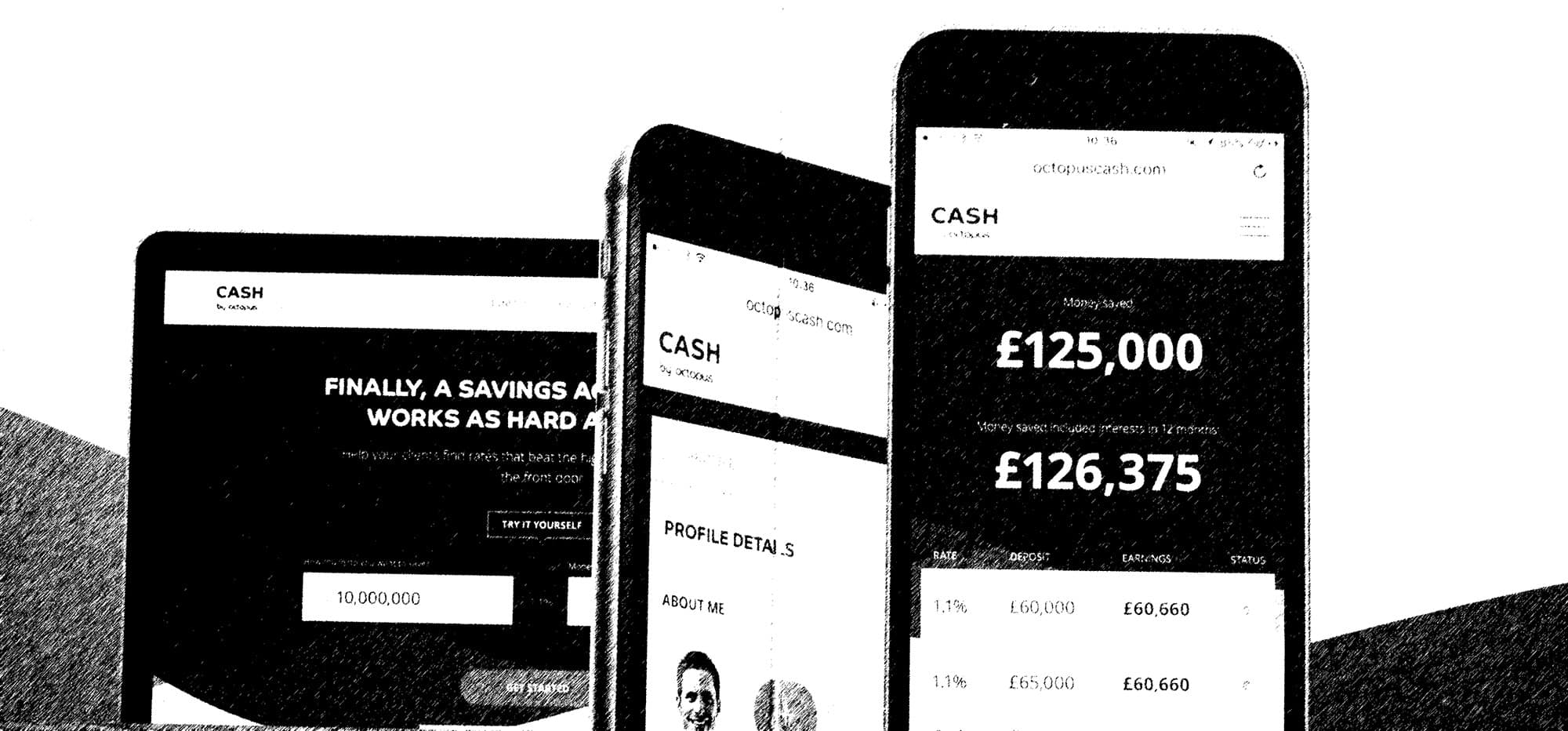

Cash by Octopus Investments helps bank account holders in the UK, get a higher return and has been able to get more than 50,000 people to sign up on their platform which now collectively manages £ 6 billion. Founded in 2000, the company has over the last 17 years built a simple and easy to use platform which has been through multiple iterations over the last decade.

How Cash Octopus Works

The company which is regulated by the Financial Conduct Authority (FCA) works with smaller banks that offer better savings rates so that you can earn the maximum from your idle cash. All you need to do is log on to their online platform and browse through the different savings accounts before choosing the option that suits you. Your savings are protected up to £ 255,000 under the FSCS. At the end of the financial year, you can choose to withdraw your money or continue saving with the new interest offered. One caveat that investors must consider is that your investments are locked in for one year, you cannot withdraw your savings before the end of the year. You can make your money work harder, invest now at https://octopuscash.com!

Want a rate higher than 1.5 % Per Annum? Then lend to Builders and Real Estate Developers

Octopus Choice is another separate platform that allows an individual to do what established government and private banks have been doing for decades. Octopus Choice is a lending platform where you can earn 4% on investments made in a portfolio of high-quality loans that are secured with the property as collateral. Your principal invested in this scheme is not protected under the FSCS. Since the loans are backed by real physical assets the risk involved is considerably lower. This is because in case of default by the borrower the loan can then be recovered by selling the mortgaged property in the open market. Since 2009, the company has lent more than £ 2.3 Billion and lost less than 0.1%. Investors get paid every month in this scheme and rates will vary over time depending on supply and demand. This is a form of peer to peer lending but has some unique characteristics that make it different from other markets

The loans are backed by collateral in the form of physical land. The company Octopus Investments also invests alongside investors.

The biggest drawback of this scheme is that it is much riskier than a fixed deposit and your investment could be affected if there is an economic downturn. If property prices crash in the United Kingdom and London in particular it would affect the borrowers. Also, these investments are not liquid and it takes time to cash them out. When you decide to withdraw your investment, the platform needs to find another buyer who is willing to lend the same amount which usually takes time. If you are ready to take the risk, then invest at https://octopuschoice.com