India Pesticides Limited IPO Details, Date, Price

An IPO is often started to inject fresh equity capital into the company, make it simple to trade current assets, raise money for the future, or monetize existing stakeholders’ stakes. India Pesticides Ltd., an agrochemical manufacturer of technical products with a burgeoning formulation division, is situated in Uttar Pradesh. Its IPO has made quite the buzz but let us first learn more about the company.

About India Pesticides Limited

India Pesticides Limited (IPL), a significant producer of agrochemicals in India, was founded in 1984. The company works in the technical and formulation business areas. India Pesticides, a maker of agrochemicals, launched an initial public offering (IPO) of Rs. 800 crores on June 23, 2021, and subscriptions ended on June 25, 2021. In addition to an equity share offering of Rs. 100 crores, a selling offer of Rs. 700 crores was made. So, the total offer size is up to Rs. 800 crores. In terms of the number of technical products produced in Fiscal 2020, it is one of the agrochemical enterprises in India experiencing the quickest growth. As well as being the only manufacturer in India, the company is one of the top five manufacturers internationally of a number of technical products, including Thiocarbamate Herbicide and Folpet. Additionally, it produces formulations for fungicides, insecticides, and herbicides. The business has a strategic emphasis on R&D, and it has two fully-equipped internal laboratories that are registered with the DSIR as part of its R&D capabilities. In order to manufacture 22 agrochemical technical products and 125 formulations for sale in India as well as 27 agrochemical technical products and 35 formulations for export, the company has secured registrations and licenses from the CIBRC and the Department of Agriculture – Uttar Pradesh.

India Pesticides Limited IPO Details

Here are some details about the IPO of India Pesticides Limited that you should keep in mind.

The entire issue amount is 800 crores, of which Rs. 100 crores were allocated to the fresh issue and Rs. 700 crores to the offer for sale. 3,409 crores are the post-issue indicated market capitalization at the band’s top. On June 23, 2021, the IPO began and ended on June 25, 2021. Each share’s price range is between Rs. 290 and Rs. 296. Up to 27,586,206 equity shares are available at the lower band. Each share has a face value of one rupee. There are 50 shares in a lot.

Competitive strength

It is important to understand how India Pesticides Limited IPO stands against its competitors, here are some points that make it unique.

Among the top 5 global players for the products Herbicide Technicals, Thiocarbamate, and Folpet. Specialized items in a product range that are diverse. Both a domestic and global market presence. History of stable financial success. R&D (Research and Development) skills.

Risk factors with India pesticides Limited IPO

Along with the benefits, you should also be aware of the risks involved with this IPO, some of which are mentioned below.

The company is required to get and keep up-to-date with a number of permissions and approvals. It is subject to stringent technical requirements, quality standards, routine inspections, and audits by its clients, which include several multinational corporations operating in the market. The current situation is such that its business requires a lot of working capital, and it will have an influence on the company’s operations if there isn’t enough cash flow from operations or if we can’t borrow enough money to cover our needs. Certain restrictive covenants contained in the company’s financing agreements must be complied with. Unable to recognize trends and client preferences. Depending on the climate and the cropping patterns. Currency exchange dangers.

Subscription Details

In the table given below are all the subscription details of India Pesticides Limited IPO.

India Pesticides Limited IPO Listing Date

Now that you know about India pesticides limited IPO details, let’s look at other important facts, such as India pesticides limited IPO listing date, India Pesticides Limited products, etc. The IPO for India Pesticides began on June 23, 2021, and it ended on June 25, 2021. The bid period for the India Pesticides IPO ran from June 23, 2021, at 10:00 A.M. until June 25, 2021, at 5:00 P.M.

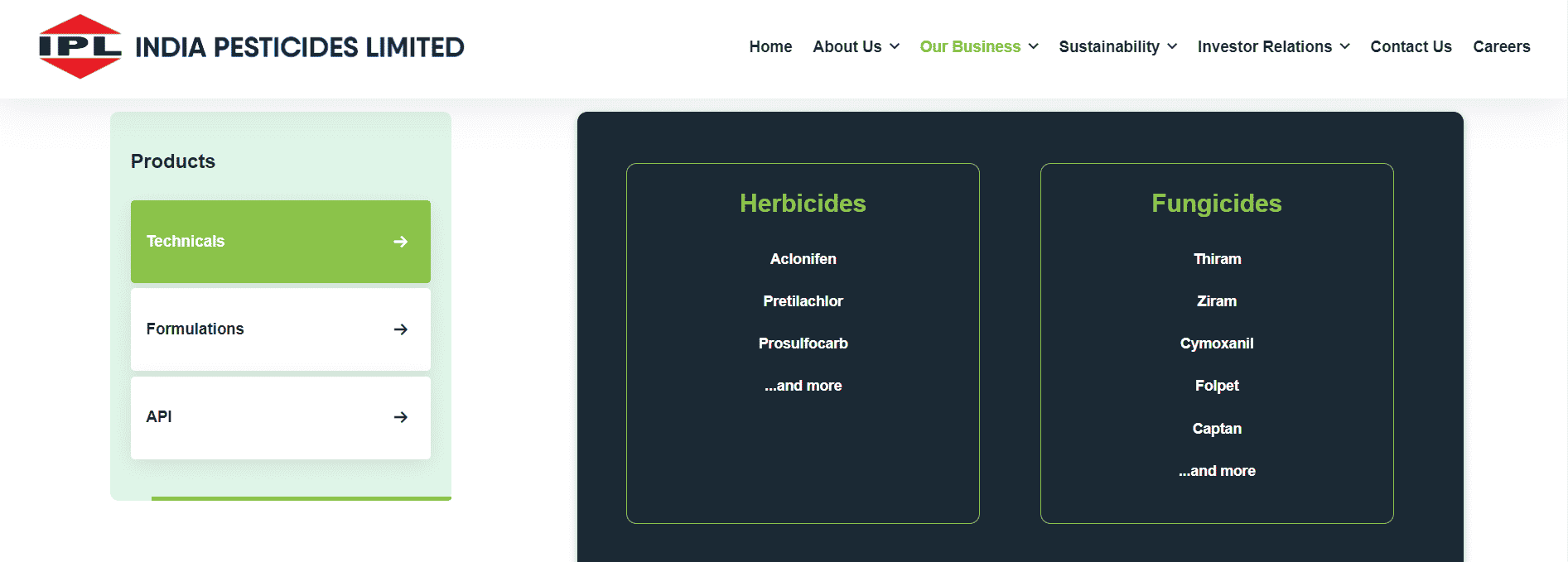

India Pesticides Limited Products

India Pesticides Limited offers three types of products on the basis of their origin. These products fall into the following categories: technical, formulation, and API.

Technical products

Here are some technical products made by India Pesticides Limited:

Herbicides – Aclonifen, Pretilachlor, Prosulfocarb Fungicides – Thiram, Ziram, Cymoxanil, Folpet, Captan etc. Insecticides – Diafenthiuron, Thiamethoxam

Formulation products

India Pesticides produces and markets a variety of insecticides, acaricides, fungicides, and herbicide formulations. These are all finished goods.

Talwar: Sulphur 80% WDG IPL-Contanol-GR: Triacontanol GR 0.05% Min IPL-Guru SP: Gibberellic acid 0.186% S.P PL Guru: Gibberellic Acid 0.001% L

API (Active Pharma Ingredients)

These are materials, or a combination of materials, meant to be utilized in the creation of a pharmaceutical product. The API becomes an active ingredient of the product when it is employed in medication.

Anti-Fungal Drugs Anti-Scabies Drugs

India Pesticides Limited IPO Allotment

You have already learned about India pesticides limited IPO details. The current IPO procedure begins when a business intends to offer stock to the general public. Even if they do not require the money, they can still issue an IPO. This is typically done in order to raise money for growth or other projects. There are several phases in the IPO process, and it might take months before it starts. One can check the allotment status by the following methods on any stock trading website. If you filed for this IPO using Groww for example, you may check your status after the allotment status is confirmed by following these steps. 1. Open the Groww App and scroll down to the IPOs section of the homepage.

2. Choose IPOs. Select the Status tab next to the Indian Pesticides IPO on the next page (or any other IPO you have applied for). If you haven’t submitted an application to the IPO yet, the status page won’t be accessible. 3. Your application number will have the word Allotted next to it if you have received an allocation through the IPO. Otherwise, the status will be shown as Rejected. It will appear as Approved until the final allocation is made. Also Read: Tatva Chintan IPO Details, Date, Price, Analysis

Check the Registrar’s Website for the allotment status

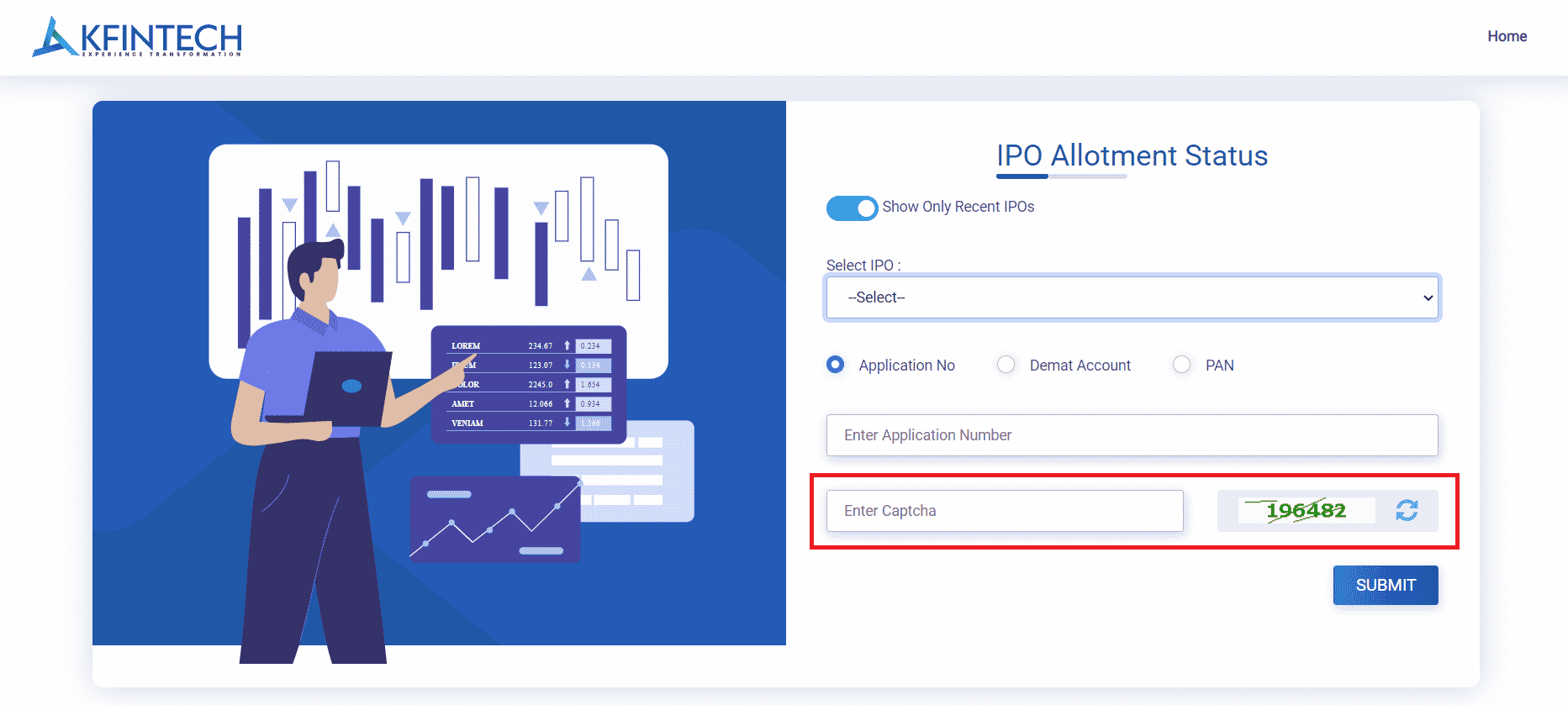

KFintech Private Ltd. is the listing registrar for this IPO. Follow these steps to check the allotment status:

Visit the KFintech Private Ltd. IPO status page, and select the IPO you want to check the allotment status. You will be redirected to a new page, here select IPO from the drop-down menu.

Select an identification option like Application Number, Demat account, or PAN.

Identify the application type. If you chose the application number as identification option, you can input it after selecting ASBA or NON-ASBA. If you selected Demat Account, input the DPID and Client ID and choose NSDL or CDSL. Insert the PAN number if you choose that option.

Now you will be asked to enter the six-digit Captcha code.

After that, to create your IPO allotment status report, simply click on Submit button. In FY2021, India Pesticides’ Return on Net Worth (RONW) was 34.5%. This is superior to all of the competitors mentioned above. Overall, it is a desirable investment due to its expanding revenues, diverse product line, large exports, improved profitability, and solid R&D. We hope you now have all the India pesticides limited IPO details including India Pesticides Limited IPO listing date, India Pesticides Limited products and India Pesticides Limited IPO allotment.