Is Keeper Tax legit? Is it Trustworthy?

Income tax is usually the biggest sum every year from which you are liable to pay the most amount at once. While you may not like it, the process is necessary and so when filing for tax, especially of certain kinds, the platform Keeper tax might be of use. Let us learn more about it in this Keeper tax review.

What is Keeper Tax?

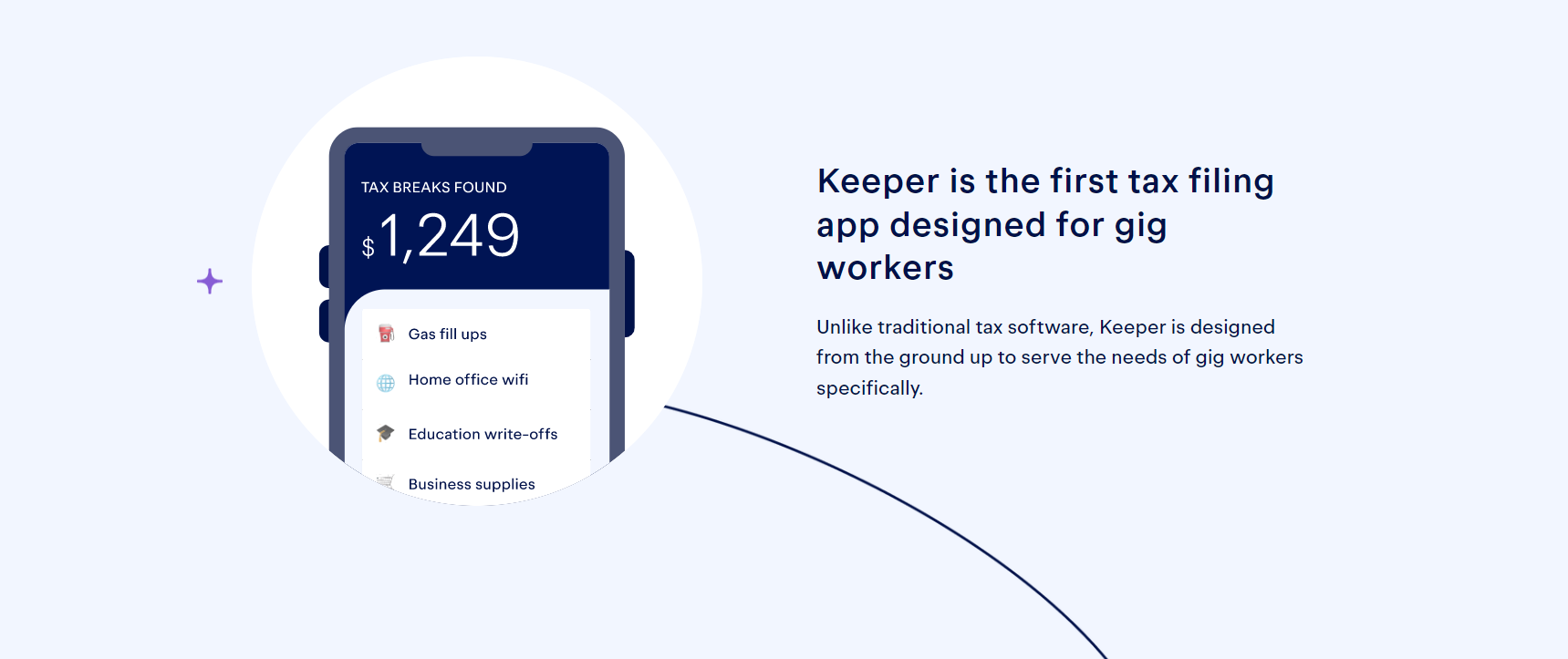

Headquartered in San Francisco, California, US, Keeper tax is a smart tax filing software. While anyone can file the tax using this platform it is specially built for people with 1099 contracts or who are freelancers. All you have to do is link your bank account with the software and it will then work its magic. Within 45 seconds the software goes through your past transactions as well to look for any potential tax break opportunities. Using this app you can e-file your taxes with the IRS and 50 states. You can have an income in the form of wages, investment, or self-employment, and the software will take care of it all. The software provides you with a fast and personalized experience while also looking for tax break opportunities in your past transactions. The software also includes Federal, State, and accountant support and complete audit protection. You can pay 99 dollars to use the software for filing a simple tax return or you can pay 168 dollars to file a tax return with business income. The software also comes with various types of calculators and other tools to help you with more tax-related issues. Now that we know a bit about the app it is time to check, is Keeper tax legit? It is the next thing we will cover in this Keeper tax review.

Is Keeper Tax legit?

Paul Koullick and David Kang co-founded the company in 2018 and since then the software has helped more than 50,000 people to save more than 40 million dollars in tax savings. There is also an app available on the App Store and Play Store and on these platforms, the app has a rating of 4.8 and 4.5 stars respectively. Also, there are thousands of positive reviews written by the users of the app which you can find on their software’s website, on its app pages, or in various articles as well. For self-employed people or freelancers, the taxation is a bit different. Usually, your tax is withheld by the employer but in these cases, it’s not, which is when you have to manually go through your earnings and expenses and find out the amount that needs to be paid in taxes. There might also be a few deduction options available to you that you might not know of which is where Keeper tax comes in and helps you find tax breaks that can help you keep a good chunk of your money with you. The software needs to be linked to your bank and credit cards and then it will start doing its work on its own. It will look for any possible deductions in tax to help you save money on tax. Also, the software is compatible with more than 10,000 financial institutions and so you should have no problem while using the app. The subscription to the app includes both State and Federal taxes and you can choose to file your returns through the app or you can choose to file them separately and download the data into a spreadsheet from their platform by paying a one-time fee of 39 dollars. Also, the app sends you a message once a day to ask you if your expenses were work-related or not and you just need to reply with a yes or no text. You also get to use quite a few free tools when using this platform. You can find out an estimate of your quarterly tax or estimate your yearly tax using the other tools provided. Features like these can help you keep ahead of the curve when it comes to managing your money so that you don’t get a shock at the end of the year. Moreover, there are various guides available on the app to help you with information about common scenarios that you might come across. So after looking at all this if we are asked if is Keeper tax legit, then we can only say yes. Anyways, we have a detailed review and more stuff to go through. Let us now begin Keeper tax review in which we will also cover Keeper tax alternatives. Also Read: Is PrizeGrab Legit? Truth Revealed

Keeper Tax Review

The tax returns are self-prepared but you can use the help of an accountant for a one-time fee of 39 dollars or you can file through someone else and just export the data from the keeper tax app on a spreadsheet for a similar charge. The app user interface is good and it is easily usable on mobile. The filing is quick and while you can manually upload the files and navigate the app easily, the app usually takes care of it too and this makes the user’s life easier. So is Keeper tax legit still? Yes, however, there are a few things that the app is still not good at. These include Schedule E (real estate) and K-1 forms that aren’t yet supported by the app. Also, farm income and gambling income are unsupported by the app as of now. The app supports Schedule C income and though that does not balance or even out things it goes on to show that the app has its strong points and weak points but it remains legit. Apart from the articles available on various subjects for the users to read and learn from, the users can also ask questions to accountants in the relevant section. Here you can email or text assigned bookkeepers to ask about specific write-offs. This app also works for you if you do a small number of crypto transactions and with this software, you also get audit protection. The app also helps you to ask for Stimulus rebate credit if you missed the stimulus check. However, the app again falls short when it comes to rental incomes which is again not supported by the app. The app however holds its own against various competitors and comes up strong with good overall ratings across all platforms. The ease of use and the features that this app offers make a good case for it. For the reasons mentioned above this Keeper tax review is more positive for us than negative and thus, so far we would still recommend it. But let’s now look at the pricing structure to get an idea about another aspect of the app.

Keeper Tax Pricing

Is Keeper tax legit? Yes. So do you have to pay for it? Yes. Should you pay for it? Come let’s find out. So as a new user of the app or website you will be allowed to use the app for free for a limited period. During this time you can use the app to get to know about it and learn if or not it works for you. After your free trial is over the app charges you 16 dollars a month. And for each tax season, you pay an additional 39 dollars or 89 dollars depending on the services you want. For 39 dollars you could either export the data from Keeper tax on a spreadsheet and use it to file for tax returns from someplace else or you can get an accountant to help you with the filing. Or you can pay 89 dollars and the app will do the State filing as well as Federal filing for you. As per the Keeper tax pricing scheme, the 16-dollar charge that you pay each month is the amount that is charged just for keeping a watch over your monthly expenses. Also, the app claims to help you save an amount close to 6,428 dollars a year on taxes which is a significant amount. So if you are paying around 200 dollars or a bit more in the year to use their services then it might be a good bargain in return for a considerable sum of money. Also, the app gives you some free-to-use calculators and information on various tax-related subjects which is a bonus for you. And with all this, there is also audit protection in place which rounds off any lingering doubts that you might have at this point. Also, Keeper tax uses the platform Plaid to ensure a safe connection is used to connect to your financial accounts. Also, the permission that you have to give to the app is read-only and so it does not store the data so again your connection with the company is safe. The app has thousands of users who have mentioned how using the app helped them save 500 dollars in 30 minutes or note their expenses being 5,300 dollars and not 3,000 dollars after using the app. And the list of such reviews is endless which is what makes us say yes to, is Keeper tax legit? While the app is good, does it hold well against its competitors? Let’s look at its competitor TurboTax before we compare the two.

About TurboTax

Owned by Intuit, TurboTax is an income tax return-preparation software based in the US. The software was developed by Michael A. Chipman of Chipsoft in 1984 before being sold in 1993 to Intuit. As per the team behind the app the software can be used for or free by people who make less than 39,000 dollars a year. The app lets you file for State as well as Federal income tax returns. Also, there are multiple versions of the service that you choose from based on the services you require. Intuit also has Canadian tax return software in place, named TurboTax as well, although it was early known as QuickTax. Now that we know a bit about TurboTax let’s see how it fares against Keeper tax and if the answer for its legitimacy is there just like that of, is Keeper tax legit. Also Read: Current Bank Review: Is Current a Good bank?

Keeper Tax vs TurboTax

Every sector in the market has competition unless it’s a monopoly. With tax filing software as well you have this competition and two of the most well-known players are Keeper tax and TurboTax. So it is now time to determine the better of the two by looking at various parameters and how both perform in those areas.

What’s in it for you?

With Keeper tax, you get to have software that is not just looking into your expenses but also helping you save money by looking out for tax breaks that you might be eligible for. The software also provides you with tools that help you estimate your quarterly tax or yearly tax in advance. You also get access to tax-related articles and can get yourself in touch with the assigned bookkeepers to get answers to tax filing-related questions that you might have. You link your credit cards and bank account to the app and it starts working itself for you. With TurboTax, you again have an income tax app that automatically inputs all your information after you have scanned the necessary forms. The platform also allows you to talk to a tax specialist via a video call to get a better understanding of certain situations. So more or less both apps have the same features but Keeper tax is specially built for freelancers and self-employed people while TurboTax is suitable for the common person. TurboTax emerges as the marginally better option ahead of Keeper Tax due to its video chat feature; otherwise, both apps are more or less similar.

Pricing War

To use Keeper Tax you pay 16 dollars a month or 168 dollars a year after the free trial period is over. On the other hand, TurboTax is free to use for people making less than a certain amount in a year or for those that have simple tax returns. If you need to go for stuff like stock sales, rentals, and other stuff then you might have to go for the paid premium version. With Keeper tax, you are paying close to 200 dollars a year or so, and with TurboTax, you have various versions available that are priced between 50 and 120 dollars. Although you might think that the price for TurboTax is cheaper, the Keeper tax software comes with various free-to-use tools that you might find useful and so the latter wins this parameter.

Which is better?

Is Keeper tax legit? Yes. Is TurboTax legit? Yes. But then why do both software have these differences in use and other stuff? It is because TurboTax is more suitable for multiple operating systems, whereas Keeper tax was built to be an app, that does not mean it won’t work on other devices but just that the app will take less screen space on a bigger monitor. Also, the TurboTax allows you to integrate files from various platforms which is also what Keeper tax allows you to do but mostly it will take care of stuff itself and you won’t have to do much. So here it feels like there is a more even balanced comparison and so it feels like a tie. So with that tie, the Keeper tax vs TurboTax comparison comes to a standstill. Both software has their strong point and weak point and ultimately is good and bad in alternate categories making them fair competitors for each other. Let us now check out some Keeper tax alternatives in this Keeper tax review.

Keeper Tax Alternatives

Still, you might be thinking, is Keeper tax legit? As we look to mention some of its alternatives. And the answer remains yes. The software is legit and remains one of the best apps around in its segment as we even saw it take its competitor head to head and be able to hold its own. However, users want to be able to choose and they need to be given options of stuff that have similar use so that they can decide for themselves which one suits them better. That is why we will be looking at a few alternatives just for your sake and not because the Keeper tax isn’t enough.

FreshBooks

On the list of Keeper tax alternatives, we first have FreshBooks, an accounting software that is built for business owners and accountants. The platform comes with a 30-day free trial and has so far been used by more than 30 million users. Even contractors, freelancers, and other parties can use this app. You can use the app to grow your business or even benefit from their affiliate or referral program.

ZipBooks

Another alternative to Keeper tax is ZipBooks, a software that helps you with invoicing and billing, and accounting and also provides you with smart insights about your business. The app is easy to use and it claims to reduce 15% of the time taken to get done with boring bookkeeping tasks. The company was born in Utah, USA, and has a lot of good reviews where people have voiced their liking and preference for this app.

Xero

Is Keeper tax legit? Yes. And so is Xero, one of its alternatives. This is yet another great accounting software that you could use to help yourself with various tax-related stuff. The app has more than 3 million subscribers who use the app to pay bills, claim expenses and do more. If you have a small business or are a bookkeeper or accountant, then this app is for you. You can use the free trial to test the app and after that, you can use their services by paying 25 dollars a month. This ends our list of Keeper tax alternatives. Also Read: How to avoid paying Capital Gains Tax on Inherited property?

Keeper Tax Pros and Cons

Now that we have looked at competitors and Keeper tax alternatives we have a better understanding of Keeper tax and similar kinds of apps and what each of them offers. This might be the correct time to weigh the pros and cons of the Keeper tax in this keeper tax review so that you easily decided whether to give this app a shot or not.

Pros

The best pro has to be the fact that the app helps you find out tax write-offs, which in turn helps you save a significant amount of money. Also, the app sends you a text daily to confirm if a purchase is work-related or not and so the app is not only easy to use but also makes sure to interact with you daily to never miss out on potential tax breaks. And lastly, the app comes with a few free tools which can be useful to you.

Cons

You spend close to 200 dollars a year on the app in various charges and for that sum, you might fund that the app is not the best one available in the market and you might have a decent alternative for a lesser price. There are also additional charges to pay if you want to use other features which take the cost further higher and make the app more expensive than it already is. Now that all the info is here and available for you to analyze, we hope you are satisfied with the answer to is Keeper tax legit? In this detailed Keeper tax review, we also informed you about some Keeper tax alternatives and their pros and cons. If you still are not convinced then you might have to look for another app, however, as for our verdict, this app is indeed a good one.